Sarasota, Manatee home values tumble, marking one of the biggest drops nationwide

Angie Ramos is concerned.

The Coldwell Banker Realtor has five listings that have sat for months. Buyer interest is at a minimum. And the stock market has been turbulent.

“We are just flooded with inventory,” Ramos said.

What she’s experiencing isn’t uncommon along the Suncoast.

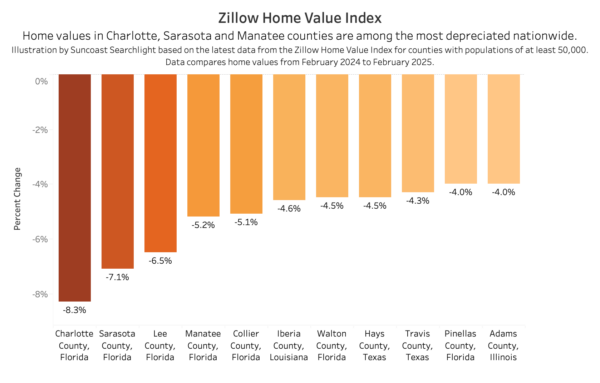

Home values in Sarasota and Manatee counties are falling faster than almost anywhere else in the country, signaling a sharp reversal in one of the nation’s most overheated housing markets and raising concerns about the broader economic health of the Suncoast.

Sarasota County saw a 7% decline over the past year, with Manatee close behind at 5%, according to the latest data from Zillow Home Value Index. DeSoto County’s home values decreased the least in our region, posting a 1% drop. The index represents the “typical” home value in a region by calculating the weighted average of the middle third of homes, according to Zillow.

While neighboring Charlotte County recorded the steepest drop of any large county in the nation — those with 50,000 or more inhabitants — at 8%, the trend across Sarasota and Manatee is part of the same regional slump and stands in stark contrast to much of the rest of the United States, where values have remained flat or continued to rise.

On average, counties across the U.S. posted a 4.5% increase in home values over the past year, according to the Zillow data. Among large counties, home values rose an average of 3.6%

The local figures mark a dramatic shift from just two years ago, when the Suncoast ranked among the hottest housing markets in the United States. Home prices surged by double digits annually between 2020 and 2022 as buyers from across the country flocked to the region during the pandemic-era migration boom.

The local figures mark a dramatic shift from just two years ago, when the Suncoast ranked among the hottest housing markets in the United States. Home prices surged by double digits annually between 2020 and 2022 as buyers from across the country flocked to the region during the pandemic-era migration boom.

Now, after three years of rapid appreciation, the market is coming back down — and quickly.

Chris Jones, an economist at the University of South Florida and founder of Florida Economic Advisors, has been warning about unsustainable price growth since 2022, when home values in the region rose by more than 30% in a single year.

“We’ve just seen prices basically get out of control over the course of the last seven to eight years,” Jones said. “And, you know, we haven’t had a bubble like this since the bubble prior to the 2008-2009 market collapse.”

Unlike that crash, which was driven by predatory lending and financial speculation, today’s downturn stems from a mix of affordability fatigue, economic uncertainty and shifts in buyer behavior — particularly among the retirees and investment-driven buyers who dominate the Suncoast real estate landscape.

This region is perhaps more vulnerable than most, Jones said, because a lot of the housing demand is tied to what he called “lifetime wealth” and investment. That includes not just retirees, but also seasonal residents and buyers whose purchasing power depends on the strength of their portfolios rather than their paychecks.

“One of the first things that happens is when consumers don’t feel good about the future,” he said, “they put off making big ticket expenditures — things like homes, autos and stuff like that.”

Buyers step back, sellers get squeezed

Recent data from the Realtors Association of Sarasota and Manatee (RASM), which historically is bullish on housing, confirms what real-estate agents on the ground are already seeing: more listings, fewer sales and a growing inventory of unsold homes.

“Across all property types, sales activity slowed compared to the previous year, while inventory levels grew, creating more options for buyers,” the RASM report stated. “Home prices showed signs of softening, with declines in median and average sale prices across most segments.”

This kind of market stagnation — where sellers are still pricing high but buyers are increasingly hesitant — often marks the early stages of a broader correction, economists say. And with inflation concerns, higher mortgage rates and shaky consumer confidence, there’s little to suggest a quick turnaround.

This kind of market stagnation — where sellers are still pricing high but buyers are increasingly hesitant — often marks the early stages of a broader correction, economists say. And with inflation concerns, higher mortgage rates and shaky consumer confidence, there’s little to suggest a quick turnaround.

A national survey from the University of Michigan shows consumer confidence has taken a sharp hit, with sentiment falling for the third straight month in February. The index dropped 12% — its steepest decline since the early days of the pandemic.

“Notably, two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009,” the university’s Survey of Consumers noted.

Jones said he does not expect consumers to feel more certain about the economy anytime soon as President Donald Trump’s tariff policy injects more chaos into the picture.

Condo law fallout adds fuel to the fire

Some of the region’s housing woes may be overstated, though, driven largely by distortions in the condominium market rather than a broad-based collapse in home values, said Alex Krumm, a past president of RASM and broker/owner at NextHome Excellence.

After the deadly collapse of the Surfside condo building in 2021, Florida lawmakers passed a sweeping reform law that requires condo buildings of three stories or more to undergo structural inspections and maintain fully funded reserves. Many older condo communities, particularly those along the coast, are now facing massive assessments to cover years of deferred maintenance.

That’s pushing some condo owners to sell at a discount — and scaring off potential buyers.

Krumm said the new law is “putting a thumb on the scale,” driving down condo prices in ways that skew the overall housing picture.

“It’s really a tale of two markets,” the veteran Realtor said.

While the drop in prices might offer some hope for affordability, especially for first-time homebuyers, it also poses risks — particularly for those who bought near the peak. Homeowners who purchased in the last two years may now find themselves with properties worth less than their mortgage, a situation that can lead to financial strain or forced sales.

Local governments could also feel the impact. Property tax revenues are directly tied to real estate values, and if assessments fall, municipalities may be forced to adjust budgets or raise tax rates to compensate.

And while many longtime residents may be content to ride out the dip, newer transplants and investors may be more inclined to cut their losses.

Signs advertising a house for sale in Whitfield Estates near the Sarasota-Bradenton International Airport. | Photo by Emily Le Coz for Suncoast Searchlight

That creates volatility — not just in the housing market, but in the region’s overall economy, where construction, real estate and related services remain major drivers of employment.

Is the bottom near?

Despite the gloomy data, some in the industry believe a floor is in sight.

“You can always tell the bottom is coming because you start to see obscene deals go through — deals that probably shouldn’t go through start to happen,” Krumm said. “You can also tell the top the same way. And we’re seeing those deals right now in real estate.”

Still, there’s no consensus on exactly when the tide will turn. Much depends on national economic trends, interest rate policy and the confidence of buyers. If consumer sentiment remains weak, prices could continue to slide for a while.

Ramos, who became a Realtor about six years ago, said this is the first time she’s experienced a jolt in the market.

She’s redoubled her marketing efforts because of the stagnant buyer pool. She’s held more open houses, sent out more fliers and posted about her properties on social media.

“It’s been tough. There’s no crystal ball,” she said. “People are afraid right now.”

Despite her worries and the challenging market conditions, she’s also banking on the long-term trends.

“What goes down must go back up,” she said. “It always does.”

Derek Gilliam is an investigative/watchdog reporter for Suncoast Searchlight, a nonprofit newsroom of the Community News Collaborative serving Sarasota, Manatee, and DeSoto counties. Learn more at suncoastsearchlight.org.