Developers aren’t alone. Greenbelt loophole tapped by Sarasota Orchestra, Mosaic and more

Real estate developers are not the only ones in Sarasota and Manatee counties to score major tax breaks through a decades-old law meant to preserve Florida farmland.

Across the Suncoast, landowners tapping the Greenbelt law run the gamut – from the Sarasota Orchestra to phosphate mining giant Mosaic, a dietary supplement supplier and Florida Power & Light, the region’s primary provider of electricity.

A Suncoast Searchlight review of more than 2,500 properties classified as Greenbelt between the two counties found that broad language in the state law left it open for a wide range of businesses and organizations to benefit from the tax savings. Critics have dubbed the loophole “Rent-a-Cow”G because real estate speculators can easily place cows on their land and qualify for agricultural tax breaks.

Under Greenbelt, instead of a property’s most valuable potential use, taxes are assessed based on a site’s current use to reflect less-profitable industries like cattle ranching, often saving the property owners thousands of dollars.

Although Greenbelt was originally intended for farmers and ranchers, a recent Suncoast Searchlight investigation found the region’s most prominent builders used the law to save money on land they intend to develop into subdivisions and shopping centers.

READ THE FULL INVESTIGATION: Sarasota, Bradenton developers score big tax breaks with “Rent-A-Cow” loophole

In 2024 alone, four developers used the law to wipe away 97% of the taxable value on properties worth more than half a billion dollars across Sarasota and Manatee counties – depriving the local governments of at least $6.6 million in lost tax revenue, the investigation revealed.

They are not the only ones to master the discount. Here’s a look at some of the other local beneficiaries of Greenbelt:

Sarasota Orchestra taps Greenbelt on site of new concert hall

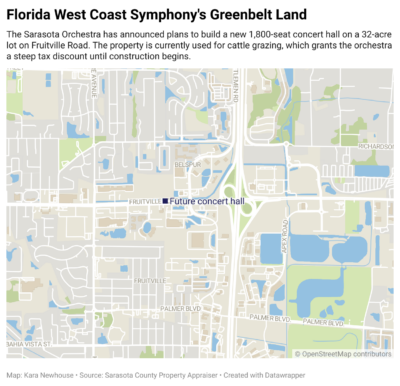

Florida West Coast Symphony Inc. purchased a 32-acre lot on Fruitville Road in Sarasota two years ago for $14 million.

Florida West Coast Symphony Inc. purchased a 32-acre lot on Fruitville Road in Sarasota two years ago for $14 million.

The Sarasota Orchestra has announced plans to build a new 1,800-seat concert hall, a 700-seat performance room, rehearsal and practice spaces, and administrative offices on the property. The orchestra now performs at various venues, including Holley Hall, the Sarasota Opera House and the Van Wezel Performing Arts Hall.

Orchestra representatives said construction timelines are fluid as they refine the project’s scope and design. The orchestra plans to open in its new home by the 2029-30 season. In the meantime, the organization tapped Greenbelt to cut down its tax bill.

With cows roaming the site – which was previously owned by the Sarasota Herald-Tribune and then Walmart – the orchestra’s property is coded as commercial “grazing” agriculture.

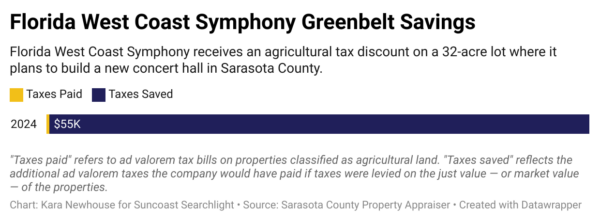

By using Greenbelt, the orchestra trimmed the value of the property that could be taxed from $4.9 million down to $23,800, property records show.

The orchestra paid $273 in ad valorem taxes to Sarasota County last year. If taxes were levied against the site’s actual market value, the bill would have been $55,765, according to Suncoast Searchlight’s analysis.

The orchestra paid $273 in ad valorem taxes to Sarasota County last year. If taxes were levied against the site’s actual market value, the bill would have been $55,765, according to Suncoast Searchlight’s analysis.

“We comply with all applicable laws and regulations, and are committed to being good stewards of the land and a responsible member of the community,” Gordon Greenfield, the orchestra’s chief marketing and communications officer, wrote in an email statement.

Palmetto dietary supplement company scores tax breaks

After his company’s annual revenue surpassed $500 million, It Works! founder Mark Pentecost spent a decade making splashy purchases across the Suncoast. They include the Stoneybrook Golf Course at Heritage Harbour, which he bought and then sold, thousands of acres in rural Manatee County and a private island off the Lee County coast.

It Works! sells dietary and weight loss supplements to independent distributors who then sell the products to consumers.

The company’s website highlights “Pentecost Island” as the ideal spot to live out its phrase: “We like to make money like Warren Buffett, but we like to party like Jimmy Buffett.”

Pentecost is also among the region’s biggest beneficiaries of Greenbelt.

Team Pentecost LLC, a company connected to the It Works! Palmetto headquarters, owns 22 properties spanning nearly 8,500 acres across Manatee County classified on the tax rolls last year as agriculture.

That reduced the value on the properties that could be taxed from $49.4 million down to $6.9 million, according to data from the Manatee County Property Appraiser.

If Team Pentecost were to pay ad valorem taxes on the full value of these sites, the total would have topped $700,000 last year alone.

If Team Pentecost were to pay ad valorem taxes on the full value of these sites, the total would have topped $700,000 last year alone.

The company instead paid $107,403.

Representatives from It Works! did not return phone calls, emails or social media messages seeking comment.

But Pentecost told the Observer last year that he visits his East County ranch almost weekly to “ride horses, round up cattle, shoot guns.” He said the property is a working ranch that raises cattle and produces sod and hay. It was also used to film a movie about Florida cattle ranchers, the Observer reported.

Mosaic claims Greenbelt classifications on agricultural sites

With $11.1 billion in net sales last year, the Mosaic Co. is the largest supplier of phosphate in the world, much of it dug from the grounds of Polk, Hillsborough, Manatee and Hardee counties. The immediate aftermath leaves behind acres and acres without a single trace of green vegetation.

Yet the fertilizer giant is one of the Suncoast’s biggest beneficiaries of the Greenbelt law, mostly through land that’s already been mined, company officials said.

A mound of phosphate from the Mosaic plant is piled high after being processed from sand dredged at the Mosaic Wingate Creek Mine in East Manatee County in 2017. | Bradenton Herald file

The mining process uses large dragline buckets that hold up to 65 cubic yards of material – large enough to fit a pickup truck inside. The machinery scoops up the top 30 feet of earth and dumps it in spoil piles to the side of the mine pit, then digs out the underground layer of phosphate rock, clay and sand, according to the Florida Department of Environmental Protection.

The mined rock is then mixed with sulfuric acid to create phosphoric acid – the base of many fertilizers. The process produces radioactive wastewater as a byproduct, which is stored in giant containers called gypsum stacks.

For decades, environmental advocates have fought to limit the mining operations in Florida. In December, the city of Punta Gorda passed a resolution encouraging DeSoto County to stop Mosaic from phosphate mining by blocking rezone requests. Charlotte County and the city of North Port have similar resolutions.

“They have really chewed up a lot of ground,” said Tim Ritchie, founder of the grassroots effort March Against Mosaic. “They treat Charlotte Harbor like a toilet, and that’s really the tragedy here. Nobody addresses that.”

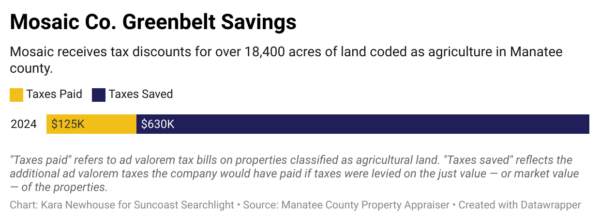

With 43 Manatee County properties classified on the 2024 rolls as Greenbelt, Mosaic is one of the region’s largest agricultural landowners. Its Greenbelt sites in Manatee span over 18,400 acres.

The company used the agricultural discounts to chop the taxable value of those properties from $54.9 million down to $8.4 million.

The company used the agricultural discounts to chop the taxable value of those properties from $54.9 million down to $8.4 million.

That reduced the ad valorem property taxes by 83%. The mining company paid $124,854 in total ad valorem taxes to the county last year, according to Suncoast Searchlight’s analysis.

Greenbelt was adopted in 1959 to provide tax relief for agricultural operations and discourage farmers from selling off their land for development. Last year, Mosaic reported $175 million in net income, according to public SEC filings.

Many of its Greenbelt sites are previous mines now leased to farmers, said Ben Pratt, Mosaic’s vice president of public affairs.

The company’s active mines are not eligible for Greenbelt, but once regulators sign off that the land has been reclaimed, the company will begin running cattle there. Mosaic also has cows on a future mining site in Manatee – part of the DeSoto mine – and leases property to a green bean farmer.

READ ABOUT OUR DATA ANALYSIS: How we analyzed the Greenbelt data

The company controls the surface rights to 27,592 acres in Manatee County, including the land classified under Greenbelt. For another 6,000 acres, Mosaic owns the mineral interest and holds deed restrictions that limit the surface owner’s activities to agriculture, said Russell Schweiss, Mosaic’s senior director of land and resource management.

“We try and get cattle on it as soon as we can because the cattle actually maintain that landscape,” Schweiss said. “It’s important we secure Greenbelt on it because a cattle lease would not cover the property taxes (if it were still taxed as a mine). It’s a fairly significant difference in the taxes we pay.”

Amid largest rate request in U.S. history, FPL saves taxes through Greenbelt

In February, Florida Power & Light Co. filed a petition with state regulators to raise utility rates charged across its 43-county service area – including Sarasota and Manatee counties – by $8.96 billion over the next four years through base rate increases.

FPL already was awarded the largest utility increase in Florida history in 2021 at $5 billion. The rate hike requested this year would represent the largest in U.S. history, according to the nonprofit Food and Water Watch, which is part of a network of organizations battling the proposed increase.

America’s largest electric utility, FPL is a subsidiary of Juno Beach-based NextEra Energy Inc. and serves more than 12 million people.

Critics of the rate increase call it a “giveaway” on the backs of ratepayers and struggling households. They point to the company’s tax breaks as another example of the strain that instead falls on the public.

Across the Suncoast, FPL has 28 properties in Manatee and one in Sarasota County classified as Greenbelt. More than 13,000 acres owned by the utility are receiving property tax discounts.

Across the Suncoast, FPL has 28 properties in Manatee and one in Sarasota County classified as Greenbelt. More than 13,000 acres owned by the utility are receiving property tax discounts.

FPL did not provide a comment.

“It’s a reflection of corporate greed,” said Brooke Ward, Food and Water Watch senior Florida organizer. “The for-profit utilities in Florida are able to ask for these increases and exploit these loopholes because (the law) allows them to do it. You can’t blame a tiger for its stripes.”

FPL paid $7 in ad valorem property taxes last year on about 5 acres of grazing land in Parrish. It paid $26 for a similar 10 acres nearby and $86 for another 40 acres.

Altogether, the company paid about $229,000 in ad valorem taxes on Greenbelt properties between both counties last year. It saved more than $350,000 from what it would have paid if the properties were taxed at market value, Suncoast Searchlight found.

Josh Salman is a deputy editor/senior investigative reporter and Kara Newhouse is an investigative data reporter for Suncoast Searchlight, a nonprofit newsroom of the Community News Collaborative serving Sarasota, Manatee, and DeSoto counties. Learn more at suncoastsearchlight.org.